Written by Amanda Jasper

Millennials are destined to change the world as we know it…

And it’s already begun.

With technological advances and adaptations unlike any other previous generation, Millennials are impacting banking innovation and customer service in ways never seen before. Financial institutions need to create strategies to keep up.

Millennials—including those born between 1980 and start of the 2000s—are now the largest, highly educated, tech-savvy, adaptable generation in recent history. Even with drastically reduced earning potential compared to previous age groups and an increased cost of living, Millennials are optimistic about their economic futures.

Brands that strive to meet the expectations of Millennials, along with the needs of other generations, will ultimately improve the customer service experience for everyone.

So how can what’s good for Millennials be good for all?

Let’s Get Digital

Everyone’s relationship with money and trust in their financial institution is unique. Not every group can be satisfied with one single solution. But for Millennials, mobile banking is what they love most.

Millennials prefer cashless payment apps, such as Venmo or PayPal, which provide a trustworthy, efficient, and socially-driven medium to make transactions. They engage in sharing expenses more than any other group, like splitting the bill at restaurants or splitting an Uber for a night out with friends. Digital wallets, such as ApplePay and Google Wallet, are also expected to drastically grow in popularity. Millennials are twice as likely to use these services as Gen-Xers and Baby Boomers. Many of these services are built into apps they already use, such as Ticketmaster and Airbnb, allowing for instant checkout.

You may have heard Millennials use the phrase, “YOLO,” meaning you only live once. Live in the moment. Don’t second guess anything – just do it.

But when it comes down to it, Millennials are more frugal in spending, more determined in saving, and more cautious in investing than older generations. Financial institutions must strategize and position their brand to match what Millennials are looking for.

Digital financial tools must be at the forefront of innovative banking since Millennials prefer an authentic, user-friendly experience. Banking should be relevant, but not overwhelming. Knowing how to reach the Millennial audience through tech-savvy mediums is key in gaining and retaining them as a customer.

Let’s Get Social

Millennials are also using financial and social apps to tackle life milestones that come their way, like saving to purchase their first home or paying off that never-ending student loan debt. According to Sam Schultz, co-founder of Honeyfi—an app designed to help couples financially at all life stages—two out of three couples keep their finances partially or entirely separate.

“Millennials want to do the same things their parents did, but have less money in the bank and are getting paid less than their parents were at their age,” said Schultz.

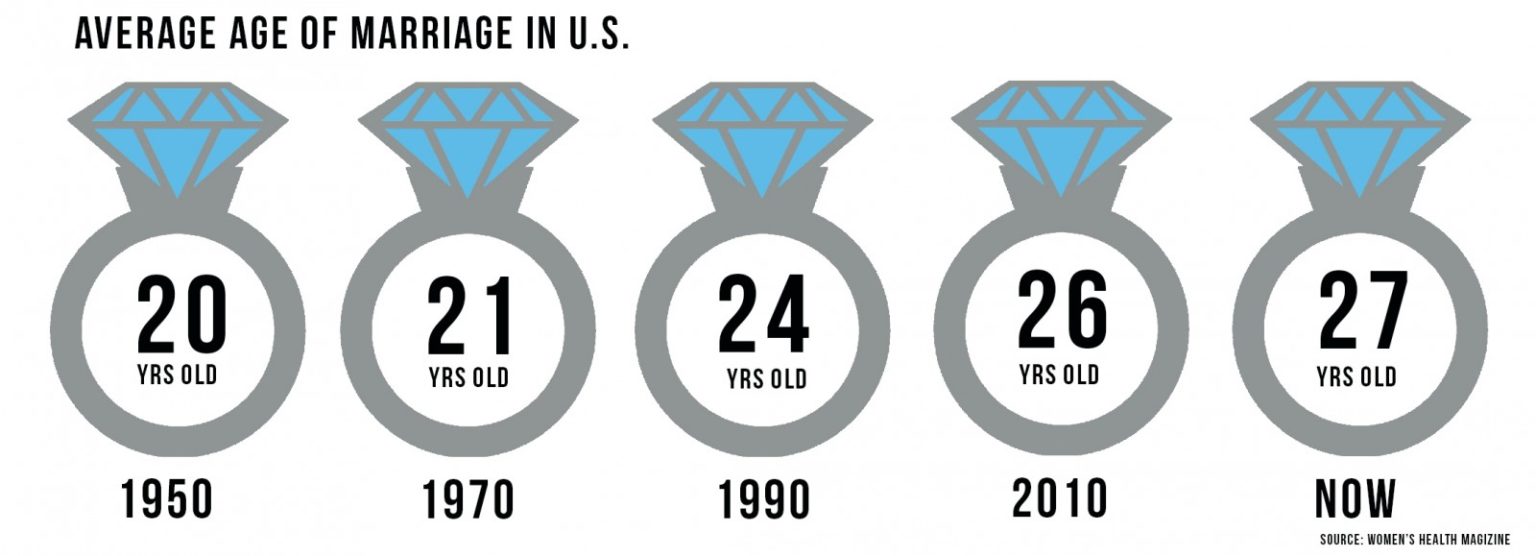

Because of this, many Millennials are waiting until later in life to marry, buy a house, and have children. They think of their money as their own. Financial institutions should embrace this and target Millennial desires, such as including social media features while on their banking journey.

Millennials rely on the convenience of mobile banking, demand instant gratification, and trust personal finance apps in ways that older age groups do not.

Does this mean that financial institutions should let Millennials completely shape their business models, right down to customer service strategies?

If brands meet the high expectations of Millennials while still paying attention to other customer needs, they can improve overall service for all generations. By offering a more personalized experience and authentic advice, financial institutions can build trust and generate brand loyalty.

Brand loyalty is never guaranteed—especially with Millennials. If you can earn it with them, then you can likely earn it from other groups along the way. Companies that take the time to understand customer needs attract more customers.

Let’s Get Personal

Millennials want a customized experience to fit their needs. If a company isn’t providing a personalized experience for them, Millennials can be quick to switch providers.

It is called personal finance, after all—so it should be personal, right?

Financial tech companies can incorporate Millennial-desired features, such as blog posts, a social media presence, and discussion topics such as, “What’s a money lesson you wish you learned sooner?” and “Using only emojis, describe your relationship.” Targeting Millennials promotes brand loyalty since they feel they are interacting with real humans instead of faceless corporate robots.

Cell phones are your most personal device, so your mobile finances must be taken very personally. Since finances have gone mobile, financial institutions can focus on what all generations have in common to gain long-term loyalty and customer satisfaction.

Diversifying communication channels and focusing on quick response time creates successful customer services, making happy customers. Banks need an omnichannel strategy to reach not only Millennials but all generations.

Responding to issues quickly is key: everyone wants fast, efficient solutions to their problems, especially Millennials. Contrary to stereotypes, Millennials align with older generations and prefer to communicate with someone in-person when faced with a problem.

Making experiences feel comfortable and familiar will help raise overall satisfaction among all generations. Talk to your customers like you would to a friend or a family member—make them feel relaxed and at home.

Everyone wants to be recognized, heard, and valued—no matter what tech trend comes next.

Source: https://telusinternational.com/articles/millennial-banking-customer-service/